Author: Jonathan Faurie

Publications: FANews

Date Published: 9 Jul 2014

Are we as an industry being protected by the regulator? We often receive determinations sent to us by the office of the Financial Advisory and Intermediary Services Ombudsman (FAIS Ombud), and there is a common thread in most of the determinations. There are certain advisers in the industry who seemingly have a blatant disregard for the Financial Advisory and Intermediary Services (FAIS) Act and they think that they can get away with defrauding clients.

Predictably they do not always get away, as the Ombud have an open door policy for the public to raise any concerns that they have regarding an adviser. The Ombud then investigates the claim and if it is found that the adviser is guilty a fine will be imposed. But is this enough? This is the question we are left with to reflect on after reading a recent determination handed down by the FAIS Ombud.

Negotiating a normal client interaction

Dr Craig Inch (complainant), a dental practitioner, was seeking an investment plan that would best suit his needs and help grow his savings. After recommendation by a college, the complainant arranged a meeting with Michal Calitz (respondent) to discuss the possible investments which would be best for the complainant.

During the original discussion, a number of unit trusts were discussed and it was recommended that the complainant look into these unit trusts. A follow-up meeting was arranged and the respondent made mention of a hedge fund that the complainant’s college, who was a client of the respondent, had spoken of. The fund was doing well and the complainant asked the respondent if he knew of any other funds which operated in a similar manner. The respondent recommended the Relative Value Arbitrage Fund (RVAF).

The complainant was hesitant to invest in a high risk fund as he was thinking of investing his whole life savings into this fund and could not afford to lose it. In the complainants version to the Ombud, he said that he made this very clear to the respondent. He asked the respondent to explain the RVAF in more detail to which the respondent explained that the fund took long positions in stocks which were expected to increase in value and short positions on stocks which were expected to decrease in value.

The complainant then asked about the performance of the fund to which the respondent assured him that the fund’s performance was in the region of twenty percent per annum.

The plot thickens

The respondent apparently told the complainant that a hedge fund was not regulated in the same way as a unit trust portfolio. The respondent then assured the complainant that the RVAF fund did have all of the correct paperwork and documentation. During the investigation of the Ombud, it was clear that this was not the case.

With regards to the fee structure, the complainant was told (as he remembers it) that he did not have to pay a fee and instead that twenty percent of the profits generated from the fund would be used as a fee.

The complainant obviously felt uneasy about the investment because he once again mentioned his reluctance to invest in a high risk vehicle as he would be investing his whole life savings of R600 000. He asked the respondent how much he should invest and the respondent recommended the complainant invest R500 000. The complainant was assured about the stability of the fund and that it was not influenced by market fluctuations. The respondent reiterated that many of his clients invested in the fund and that he was also an investor in the fund.

When the complainant wanted to withdraw R600 000 from the fund, he emailed a letter of intent to the fund, to which he was informed of the death of Herman Pretorius who was a fund manager and a trustee of the fund.

Opening a can of worms

Unlike many other recent determinations, the respondent did respond to the allegations made to the Ombud.

In his defence, the respondent said that the complainant asked about the RVAF and not the other way around. In the record of advice there was also no indication that the respondent mentioned to the complainant that hedge funds are not regulated in the same way as unit trust funds.

Two articles on a prominent media site unsettled the respondent and prompted him to withdraw all of his client’s savings out of the RVAF. However, he did not mention what particular aspects of the articles made him withdraw the funds.

The respondent further adds that he cannot accept responsibility for what seems to be one person’s deliberate intention to defraud investors.

Unearthing a long list of infringements

The list of aspects of the FAIS Act which the respondent infringed on in this case was very extensive and took up twenty pages in the Ombud’s determination, which can be read here.

One of the most important aspects of the FAIS Act which the respondent contravened was the poor selection of the vehicle in which the funds were invested. During the Ombud’s investigation it was found that there was no financial needs analysis done. The respondent did not present a range of options which could have been invested in other than the RVAF and the complainant never received any documentation that the RVAF was the fund that his capital was invested in. There was also a significant grey area on who the respondent was representing.

Was justice served?

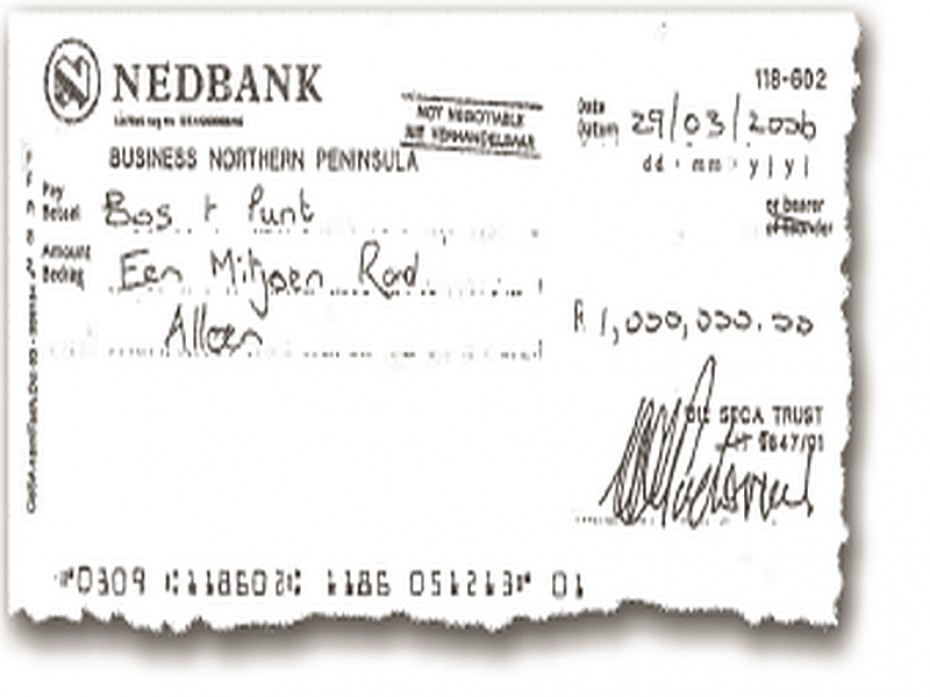

Upon the death of Herman Pretorius, the RVAF went into liquidation and all of the capital invested in the fund was lost. However, the complaint was upheld by the Ombud as it ruled that the capital should never have been invested in this fund in the first place. The respondent was instructed to pay the complainant R500 000 and interest at a rate of fifteen point five percent per year.

What is the role of the Financial Services Board (FSB) in this debacle? Despite the fact that Calitz should have been dealt with by the regulator long before this determination took place, the issue is what will happen to Calitz now? The ruling of the Ombud can hardly be described as a slap on the wrist, but if he is allowed to continue practicing, is justice being served? In all fairness, the FSB should suspend Calitz and never allow him to practice again.

Editor’s Thoughts:

The financial services industry operates on public perception. If the public thinks that one adviser is fraudulent, they may paint a lot of other advisers in the industry with the same brush. The FSB has a duty to fight for the reputation of the industry. Is it fulfilling its role? Please comment below, interact with us on Twitter at @fanews_online or email me your thoughts jonathan@fanews.co.za.

Tags: Dr Craig Inch, Fais, fanews, FSB, Herman Pretorius, Jonathan Faurie, Michal Calitz, RVAF